Find customised home loan solutions for your unique needs

Find a better interest rate for your existing home loan

Get a loan on your existing home loan to meet your needs

Turn your assets into a financial ally

Discover your financial fitness - check your credit score

Home Loan EMI CalculatorGet an estimate of your Home Loan EMI now

Mortgage CalculatorCalculate your Loan amount for your Current property

Home Loan Eligibility CalculatorAre you eligible for a Home Loan? Find out now!

Popular ArticlesMeet all your dreams and needs with a collateral-free Personal Loan

Make loan repayment flexible and hassle-free with Flexi Loans

Credit TrackDiscover your financial fitness - check your credit score

Personal Loan Eligibility CalculatorAre you eligible for a Personal Loan? Find out now!

Personal Loan EMI CalculatorGet an estimate of your Personal Loan EMI now

Meet your financial needs with a collateral-free loan

Get loans for all your business needs at attractive rates

Credit TrackDiscover your financial fitness - check your credit score

Business Loan EMI CalculatorCalculate your Business Loan amount and EMIs

Related ReadsDiversify your portfolio and reduce risk with Debt Funds

Invest smartly in Equity Funds to aim for higher returns

Diversify your portfolio and reduce your risk with a mix of equity and debt

Goal-oriented fund with a lock-in period to create a corpus for retirement

Secure your child’s financial future with solutions-oriented children’s funds

Unlock a smart, hassle-free way to invest in various assets

Choose the smart way to diversify risks and grow investments

Follow the benchmark of smart investors to grow your wealth

Aditya Birla Sun Life Mutual FundVisit to start your investment journey.

Mutual Fund Lumpsum CalculatorCalculate wealth creation through lumpsum investment in Mutual Funds

Open Demat AccountGrow your wealth with our Demat account

Portfolio TrackBring your assets and liabilities under one platform

SIP CalculatorCalculate wealth creation through Mutual Funds SIPs

Related ReadsInvest or trade in equity for attractive returns and long-term capital growth

Get up to 5X leverage on leading stocks & increase your trading power

Give your portfolio stability with attractive returns

Open Demat AccountOpen a Paperless Trading Account in Minutes

Related ReadsInvest in one of the safest ways to grow your money

Invest in gold without worrying about purity, storage or safety

SIP CalculatorEasily calculate your monthly investments to meet financial goals

Related ReadsPlan your taxes to claim suitable tax benefits and enhance your savings

Related ReadsBring security and peace to life’s unpredictability

Get a guaranteed regular pension plus lump sum on plan maturity

Get a guaranteed regular pension plus lump sum on plan maturity

Get the benefits of insurance & wealth creation in one convenient plan

Human Life Value CalculatorFind out how much life insurance you need with our Human Life calculator

Related ReadsMake quality health care affordable and accessible

Get extra coverage when you need it most

BMI CalculatorMeasure your body mass index to start your journey to better health

Related ReadsChoose from comprehensive protection plans for your two-wheeler

Protect your car against third-party liabilities and damage

Tax PlanningPlan your taxes to claim suitable tax benefits and enhance your savings

Related ReadsUtility bill payments made easy with BillPay

Shopping grocery, lifestyle or paying bills, pay anything with our payment solutions

Sending money to individuals and businesses made easy and instant

Pay on call in 3 simple steps by providing your UPI ID

Check your credit score and get tips on how to improve it

Health TrackHealthy living made easy with ABCD’s Digital Health Evaluation

Portfolio TrackBring your assets and liabilities under one platform

Spend TrackManage your money effectively with Spend Track.

Popular ArticlesUnlock Financial Tools, Investment Insights, And Expert Guidance – All In One Convenient App.

Protect the dreams and aspirations of your loved ones with an affordable and effective comprehensive Term Insurance plan.

Death benefit during the policy term Flexibility in coverage and tenure Financial security and tax benefit*Claim Settlement

Ratio

Life Insurance Advisors $

Crores Asset Under Management $$

Years of

Excellence

Term Insurance is a simple and affordable Life Insurance plan that provides financial protection for your family for a specific period, in case of your untimely demise.

Ensure your loved ones are financially secure in case of your untimely demise

Flexible Coverage PeriodChoose your policy term depending on your needs.

Multiple Payout OptionsGet the payout as a lump sum, monthly, or a combination of the two.

Boost your coverage with add-on benefits.

RenewabilityRenew your policy without any hassle at the end of the coverage period.

Critical Illness BenefitGet the sum assured on the first diagnosis of a listed critical illness without delay.

A practical and economical way to safeguard your family's financial future. Choose a policy that fits your needs and budget.

ABSLI DigiShield Plan KEY FEATURESUIN: 109B017V03 Waiver of future premiums for the rest of the policy term if the insured is diagnosed with a specified Critical Illness or suffers permanent disability due to specified Critical Illness or accident.

Before you purchase Term Insurance, ensure you qualify and have the necessary documents.

Pick a plan that fits your needs

Share the required personal details

Select sum assured, riders, payment cycle, etc.

Go through the coverage and exclusions

Make payment and submit the documents

Go through the coverage and exclusions

Make payment and submit the documents

Ways to save taxes with Term Insurance

As per the Income Tax Act, 1961

Simple processes when you need it most

Important claim information

Exceptional conditions for benefits

Submit basic policy details

Submit cause of death/ event details

Submit relevant documents

Download and fill up the claim form

Collect necessary supporting documents

Submit claim form & supporting documents

Submit basic policy details

Submit cause of death/ event details

Submit relevant documents

Download and fill up the claim form

Collect necessary supporting documents

Submit claim form & supporting documents

Hear from our customers what they have to say about their experience.

Aditya Birla Sun Life Insurance Customer

Due to seamless branch support and timely communication from ABSLI, my maturity payout process was quite smooth.

Aditya Birla Sun Life Insurance Customer

Aditya Birla Sun Life Insurance Customer

Entire surrender process was quite smooth with timely documentation and payout. Great experience!

Aditya Birla Sun Life Insurance Customer

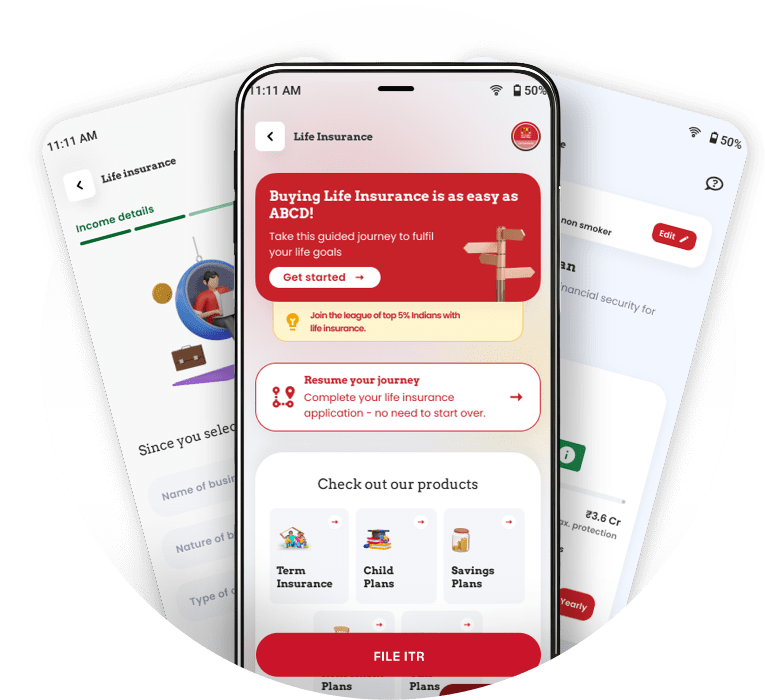

ABCD - One app for all your insurance needsSecure yourself and your loved ones financially with life insurance. Buy online through the ABCD app and get instant coverage.

Range of insurance policies to choose from Online premium payments Few clicks to buy the plan Download our mobile app now

Scan the QR code to download our Mobile App

Even if you does not have dependents yet, you may have education or home loans. Term insurance can ensure the burden of repaying the loan doesn’t fall on your parents.

If you are newly married or plan to start a family soon, a term insurance policy can provide financial security for your spouse and ensure a better future for them.

If you are the primary earner in your family, a Term Insurance policy can help replace your income and support your loved ones in case of your untimely demise

If you have young children, a term insurance policy can help secure their education, upbringing, and even marriage if you are no longer there.

If you have your own business, you may use term insurance to safeguard your business interests, such as loans, partnerships, or succession planning.

40-50 years. The term should last at least until the loans are repaid. In case of an unfortunate event, the death benefit should be able to repay the loan.

25-30 years. The term should last until the child’s education and marriage. Consider your lifestyle, the cost of education, etc., to determine the amount.

15-20 years. Your children may only need your support for a little longer but think of any outstanding mortgages you still have to pay.

10-15 years. With your children independent now, financial security for your spouse is the only obligation left.

Term insurance is one of the most affordable types of life insurance. You can get a high coverage amount at a relatively lower premium than policies offering lifelong coverage.

Term insurance can provide financial security for your family and dependents in the event of your untimely demise. The death benefit can be used to pay off debts and provide for their living expenses.

It is highly flexible and can be customised to meet your needs and budget. You can choose the term of the policy, the coverage amount, the payout option, and even additional cover with riders.

Term insurance is a pure protection plan and does not involve any hassle or risks associated with investments.

Term insurance can give you peace of mind, knowing that your loved ones will be financially protected in the event of your untimely demise.

Term insurance premiums are eligible for tax deductions under Section 80C of the Income Tax Act, 1961. Additionally, the death benefit paid to your beneficiaries is also tax-free under Section 10(10D)** of the Income Tax Act, 1961

You can claim a tax deduction on the term insurance premiums you pay.

Any term insurance for yourself, your spouse, and your dependent children is eligible.

You can save up to ₹1,50,000 of your annual taxable income through insurance premiums.

Even the death benefit paid out to your beneficiaries is entirely tax-free under Section 10(10D)** of the Income Tax Act, 1961.

There are no maturity benefits in Term Insurance, as it is a pure protection plan that provides coverage for a specific period. However, Aditya Birla Sun Life Insurance offers maturity benefits through the Return of Premium.

Return of Premium (ROP) is a feature or rider offered with some term Life Insurance policies that offer a refund of the premiums policyholder pays if they outlive the policy term

You will typically pay lower premiums if you are younger.

Women typically pay lower premiums than men.

You will likely have higher premiums if you have health problems.

Your lifestyle choices, such as smoking, drinking and excess weight, can increase your premiums.

Risky professions such as construction, mining, oil exploration, firefighting, etc. will likely have higher premiums.

The type and duration of policy you choose can also affect your premium.

A Term Insurance plan offers a financial safety net to your family against day-to-day expenses, loans, liabilities, and EMIs. It can also fulfil future needs, such as your child's higher education, marriage, etc.

Among all the Life Insurance products, Term Life Insurance offers the highest life coverage for the lowest premiums.

It is best to buy Term Insurance early in life. Premiums are lower, and you can get more extended coverage. The ideal age is between 25 and 30, when you will likely have dependents and liabilities. But it's never too late to buy Term Insurance, and people in their 50s can still benefit from its financial security.

The cost of Term Insurance is calculated by looking at different things that tell the insurance company how much of a risk it is to cover a person. The key factors that affect the premiums are:

• Age: Younger people typically have lower premiums than older people because they are less likely to get sick or injured.

• Gender: Women typically pay lower premiums than men because they have a longer life expectancy.

• Medical History: If you have health problems, you will likely have higher premiums. It is because the insurance company is more likely to have to pay a claim for you.

• Lifestyle: Your lifestyle choices, such as smoking, drinking and excess weight, can increase your risk of health problems, which can also affect your premiums.

• Profession: Some professions are considered riskier than others, such as construction, mining, oil exploration, or firefighting. If you have a risky job, you will likely have higher premiums.

• Policy type: The type of policy you choose can also affect your premium. For example, term Life Insurance is typically less expensive than Life Insurance with additional riders.

• Sum insured: The higher the sum insured, the higher your premium.

Term Insurance aims to support your family if you die unexpectedly financially. It covers various types of deaths during the policy period, with the most common ones being:

• Natural death: Death due to illness, disease, or old age.

• Accidental death: Death due to an accident, such as a car accident, drowning, or falling from a height.

• Terminal illness: Death due to a terminal illness, such as cancer, where the policyholder is diagnosed with a disease that is likely to result in death within a specific period.

• Disability: Death due to a disability caused by an accident or illness, where the policyholder is unable to earn a livelihood.

Term Life Insurance policies offer different ways to pay the death benefit to the beneficiary if the policyholder dies. The most common payout options are:

• Lump sum payout: The entire death benefit is paid at once. It is the most common option and gives the beneficiary immediate access to the funds.

• Income payout: The death benefit is paid in regular instalments over a time. This option can be helpful for beneficiaries who need a steady income stream.

• Combination payout: A portion of the death benefit is paid as a lump sum, and the rest is in instalments.

• Increasing payout: The death benefit increases over time to keep up with inflation. It can provide better financial security for the beneficiary in the long term.

Our Other Plans Retirement PlanSafeguard your loved ones and build your retirement wealth simultaneously. Begin today for a worry-free tomorrow!

Savings PlanEnjoy insurance coverage and also save up for your financial goals with Savings Plans.

Get the best of both worlds with a plan that grows your wealth and provides insurance coverage. Secure your and your family’s future now.

*Tax benefits are subject to changes in tax laws. Kindly consult your financial advisor for more details.

**Sec 10(10D) benefit is available subject to fulfilment of conditions specified therein.

#Provided all due premiums are paid.

^ As per annual audited figures submitted to IRDAI for the period FY 22 – 23 for individual death claims paid.

$ As on 30th November 2023

$$ As on 31st December 2023

¹ABSLI DigiShield Plan scenario: Female, non-smoker, Age: 21 years, level Term Insurance, Premium paying Term: regular pay, policy term: 25 years, Pay frequency: Annual Premium of ₹ 6500/12 months = ₹ 542/month) Exclusive of GST (offline premium).

ABSLI DigiShield Plan (UIN:109N108V11) is a non-linked non-participating individual pure risk premium life insurance plan; upon Policyholder’s selection of Plan Option 9 (Level Cover with Survival Benefit) and Plan Option 10 (Return of Premium [ROP]) this product shall be a non-linked non-participating individual life savings insurance plan. All terms & conditions are guaranteed throughout the Policy Term. GST and any other applicable taxes will be added (extra) to your premium and levied as per extant tax laws.

ADITYA BIRLA CAPITAL DIGITAL LIMITED is a corporate agent of Aditya Birla Sun Life Insurance Company under IRDAI Registration No: CA0871 and does not underwrite the risk or act as an insurer.

Registered Address:18th Floor, One World Center, Tower 1, Jupiter Mills Compound,841 Senapati Bapat Marg, Elphinstone Road Delisle Road, Mumbai Maharashtra 400013. Participation by the ABCD’s clients in the insurance products is purely on a voluntary basis.

The Trade Logo “Aditya Birla Capital” Displayed Above Is Owned By ADITYA BIRLA MANAGEMENT CORPORATION PRIVATE LIMITED (Trademark Owner) And Used By ADITYA BIRLA SUN LIFE INSURANCE COMPANY LIMITED (ABSLI) under the License. This policy is underwritten by Aditya Birla Sun Life Insurance Company Limited (ABSLI). This is a Non-Linked Non-Participating Individual Pure Risk Life Insurance Plan. GST and any other applicable taxes will be added (extra) to your premium and levied as per extant tax laws. An extra premium may be charged as per our then existing underwriting guidelines for substandard lives, smokers or people having hazardous occupations etc. For policies issued on minor life, the date of commencement of risk shall be the date of commencement of the policy. Where a policy is issued on a minor life, the policy will vest after attainment of majority of the Life Insured. Where the Life Insured (whether major or minor) and Proposer/Policyholder is different, on the death of the Proposer/Policyholder, his legal heirs, in accordance with the existing succession laws, will be considered as new Proposer/Policyholder. Tax benefits are subject to changes in tax laws.

For more details on risk factors, terms and conditions, please read the sales brochure carefully before concluding the sale. Registered Office: One World Centre Tower 1, 16th Floor, Jupiter Mill Compound, 841, Senapati Bapat Marg, Elphinstone Road, Mumbai - 400013. IRDAI Reg No.109 | Toll Free No. 1-800-270-7000 | Website: https://lifeinsurance.adityabirlacapital.com | CIN: U99999MH2000PLC128110 | UIN: (Has been mentioned for individual products above)| ADV/3/23-24/3896

BEWARE OF SPURIOUS / FRAUD PHONE CALLS!

IRDAI is not involved in activities like selling insurance policies, announcing bonus or investment of premiums. Public receiving such phone calls are requested to lodge a police complaint.