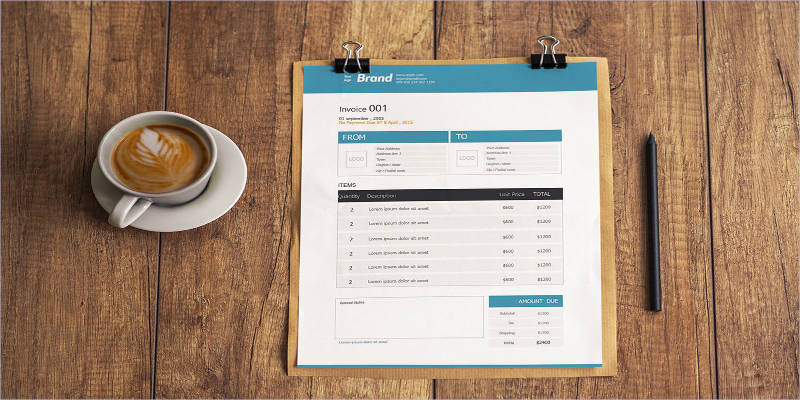

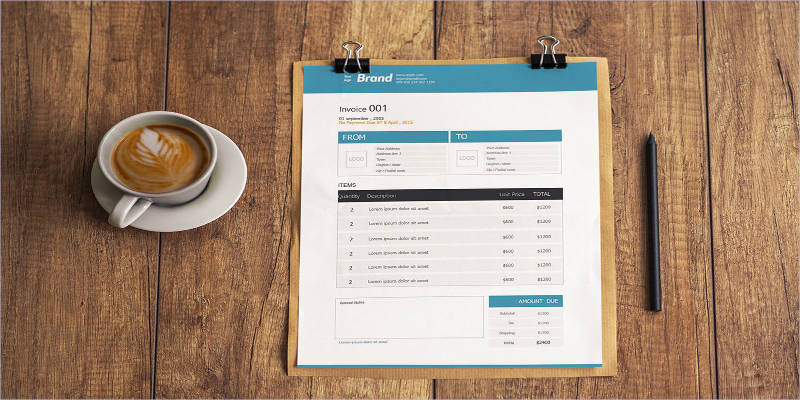

Part of the struggles in running a business, aside from having to fund it, is having to make invoices. For those who do not know what an invoice is, it is an official document used to record the products or services exchanged in a certain business transaction involving two parties or more.

As most of us probably know, there are varieties of invoices. The reason for this is that certain business transactions need to document specialized details in order to be official. A few examples are commercial invoice, purchase invoice, consulting invoice, billing invoice, and a whole lot more.

A non-trade invoice is a document, another type of invoice, issued for those transactions that are not directly related to the company’s operations or production. As we are all aware, invoices are given when there is a direct exchange of mutual agreement for a purchase of product or taking advantage of a particular service.

In order to categorize if a supplier is a trade or non-trade, simply identify if the goods or services that is being supplied to you is directly involved in your production or the operation of your business invoice. Any third party agent that is not directly involved in your major operations is considered a non-trade supplier.

In the world of accounting, it is a common scenario to encounter terms like accounts payable and creditors. You need to be able to clearly identify each term and know its meaning in doing your job.

When you are tasked to take care of accounts payable, for simple invoice example you need to differentiate between trade and non-trade creditors and suppliers. In order to separate trade and non-trade creditors in accounts payable, tag the trade creditors as payable (since these are the ones that are directly related to your primary operations), and tag non-trade creditors as other payables, such as “utility” or “taxes”.

The most basic use of an free invoice is to provide a record for both the seller and the buyer. For the seller’s part, an invoice can be used as a way to improve bookkeeping and to ensure that expenses are all accounted for. Every purchase and every product that comes out of the usual production is recorded so that at the end of a certain period, it can all be collated and assessed.

Through this process, the finance team can assess and calculate how much is the income from the release of the products and how much of it was dispensed. For the buyer, one can use the invoice to check if the items on it are true and accurate before a payment invoice is made to the seller. We all want to make sure that we are giving the right amount that is due for the purchase that we made.

The same thing happens with a non-trade invoice. It basically helps the issuer to determine which is due for a non-trade transaction and which is for a trade transaction. A non-trade invoice is issued for a company that is not in direct connection with its principal operation and is merely an accessory to supply non-essential needs for the business.